The Industry’s Brightest Continue to Provide Poor Returns for Clients

Yet another hedge fund is closing its doors. TeamCo Advisers, LLC, with about $1.0 billion under management, is calling it quits by early 2018. Poor returns have hamstrung the fund. It’s yet another victim of the Fed’s low interest rate liquidity-infusion dysphoria.

Despite the historic bull run that has seen the S&P 500 rise 375% off the 2009 lows, TeamCo only produced a composite return of 3.4%, net of fees, from July 2007 through July 2017—with a gain of 4.8% this year through July. Both long-term and 2017 returns have severely lagged behind simple passive indexing. (Source: “Exclusive – Perry’s TeamCo is latest hedge fund industry casualty,” Reuters, September 25, 2017.)

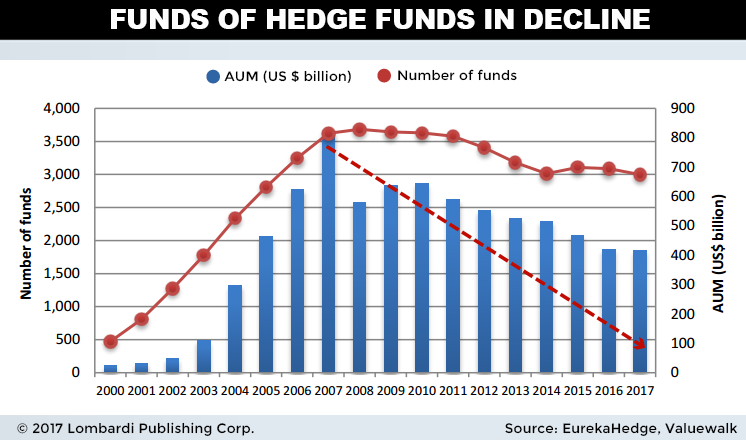

The news of yet another hedge fund closure is not particularly surprising. Many funds have struggled to keep pace with simply indexing strategies, net of fees. What’s interesting is the stark choice of words that the managing partners have chosen to describe today’s investing environment.

TeamCo Principal David Perry says, “Whether it’s an anomalous period or not, the last 9 years has been brutally challenging for hedge funds of virtually all styles and strategies.” (Source: Ibid.)

That brings up the question: If some of the smartest people of Wall Street (the “pros”) are chalking up poor returns, what makes average investors think they can outperform the market? It’s doubtful that Joe Investor has better access to proprietary research—or trading fees, dark pool access, and execution ability.

But what about indexing? That simple strategy seems to be outperforming many of those flashy, expensive funds. There’s definite truth in that statement.

But millions of investors are thinking along the same lines. Doing what most others are already doing is not a good investment strategy—it’s a lemming run looking for the next cliff.

So, next time you plan on putting money to work, consider that even Wall Street’s best are having a difficult go of it. Passively indexing is the sexy thing right now, but it’s a crowded ship. There is a multitude of catalysts which could cause it to capsize.

Ultimately, Wall Street funds are slowly being gobbled up by the Federal Reserve’s liquidity trap, and I suspect the same thing to happen with retail investors when the tide shifts in the other direction.