Debt Could Has Become the Major Risk to the U.S. Economy

In a world that’s swimming, or rather drowning, in debt, Moody’s Corporation was keen to notice the splinter in China’s eye. But Moody’s chose to keep mute over the beam in America’s own.

In fact, the United States is the unflustered owner of federal debt that’s 104% of gross domestic product (GDP). That means the U.S. is one of the most indebted countries in the world, which raises the risk of economic collapse.

The European Union (EU) countries aren’t doing much better. On average, their debt-to-GDP ratio comes close to 100%. Within that same EU, the debt levels of Italy and Greece could explode at any moment, triggering a spiral of financial collapse in Europe. Meanwhile, quietly, Japan’s debt is some 200% of its GDP.

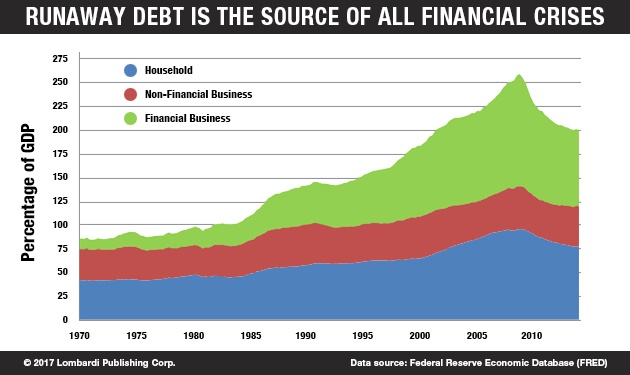

The enormous public debt levels of many countries spreads out the shame, as it were, of debt. After all, if so many advanced economies have such huge public debt loads, it might be a symptom of prosperity, goes the logic. But there is another debt problem that is hitting Americans much closer to their wallets and purses: personal debt.

Personal Debt Is a Threat to American Prosperity

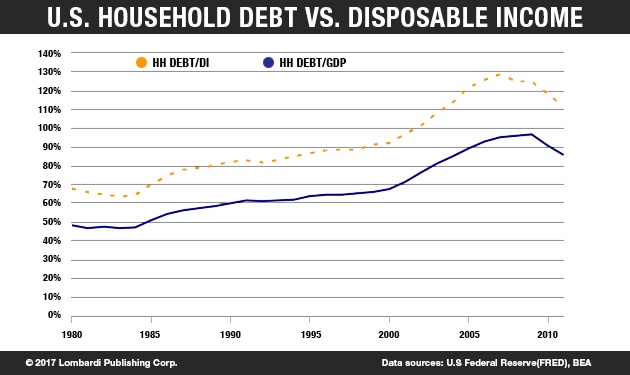

There’s no escaping from personal debt. Unlike the debt-to-GDP ratio of the nation, personal—that is, household—debt affects what you can and cannot do during a given day. It also determines the kind of lifestyle you live and, especially, the kind of retirement you can expect. Whether you think about retirement with joy or grief might depend on your level of personal debt. Judging by recent statistics, household debt in America has become a major, if not its biggest, problem.

The debt accumulated by U.S. households as of 2017 exceeds the peak reached during the Great Recession that began in 2008. Household debt has reached a sum that staggers the imagination. At the end of March 2017, it stood at $12.73 trillion, which is $50.0 billion more than the record set in the third quarter of 2008. (Source: “Household Debt Makes a Comeback in the U.S.,” The New York Times, May 17, 2017.)

The sum is beyond imagination. To get a better grasp of how alarming debt has become, consider that household debt accounts for around 70% of U.S. GDP, which was about $18.0 trillion in 2016. Compared to other leading economies, American household debt is four times bigger than Germany’s GDP (which was $3.9 trillion in 2016).

The ballooning debt accumulated by American families and individuals has been largely fueled by mortgages. That should activate the economic collapse alarm, as mortgage debt was at the heart of the 2008 recession in the United States.

More than half of these Americans have so much debt that they are but $500.00 away from bankruptcy. That is, they don’t have a few hundred dollars available to cover an emergency expense like an urgent car repair or medical treatment.

Risky Auto Loans Are the New Subprime Mortgage Loans

Then there’s the rising phenomenon of what might be called subprime auto loans. This could soon blow up and kill the thriving U.S. auto market. Auto loans taken outside of the traditional financial institutions have allowed the auto market and auto industry to thrive. But the risk of default has reached dangerous levels. The risks are all the higher if the U.S. Federal Reserve decides to continue raising rates.

The fact is that many have already started to fall behind on their auto loans. These now total over $1.1 trillion, of which about a sixth are in the “subprime”—that is, risky—category. By the end of 2016, some $23.0 billion in new auto loans were already past due. That’s a higher rate than in 2008. Should this continue, it could severely damage car sales and force major cuts in the car manufacturing industry. (Source: “The Auto Loan Industry’s Warning Light,” Bloomberg, February 21, 2017.)

Now many Americans are wondering whether President Donald Trump’s tax plan will pass the Congressional vote. Yet, there is the slow but sure realization that the economy did not thrive during the Barack Obama period. It turns out that this impression is right; President Obama did not leave a healthy economy. The stock market and the Dow Jones are higher than when Obama took office in 2009, but Wall Street and Main Street economics don’t go hand in hand.

Debt Is Rising and GDP Growth Is Slowing

GDP growth was 1.6% in 2016. As the results showed in April, the first three months of 2017 showed GDP growth dropping to 0.7%! That’s barely any growth at all. Trump has inherited a problem-filled economy, loaded with debt. It will impact his approval ratings. That’s because there is little he can do to achieve his targeted goal of three-percent annual GDP growth.

That’s looking ever more unrealistic, and it also depends on one basic factor. Even one or two percent GDP growth can only happen if growth actually continues in the first place. The financial and economic perils are everywhere. The risk of a financial collapse, a market crash, and another recession is always around the corner, and warrants more caution than optimism.

Strangely, the Federal Reserve and others don’t seem to worry about this; they barely see it as a problem. The Fed pulls a technocratic rabbit out of the hat. They see debt as a cause for celebration. (Source: “Household Debt Surpasses its Peak Reached During the Recession in 2008,” Federal Reserve Bank of New York, May 17, 2017.)

In other words, the Fed does not see the rising debt as a sign that the economy is heading toward another financial crisis.

The Fed’s logic suggests that the financial crisis of 2008 was caused by the accumulation of poor-quality (toxic) real estate loans—the infamous subprime mortgages, which had been securitized—that spread their toxicity from bank to bank like rats spread the plague during the Middle Ages.

Don’t worry, says the Fed, the situation is much better today. Overall, debt service has improved considerably since the financial crisis, even though defaults remain very high for student loans, and are on the rise for automobile loans. Defaults are also on the rise for housing or mortgage loans. Indeed, the logic is as convoluted as you might expect from savvy bankers.

The fact that Americans are taking on more debt means (at least, they want us to believe this) that Americans have improved their credit scores. It suggests Americans are optimistic about the economy. (Source: The New York Times, op cit.)

Some of this might be true: the part about Americans improving their credit scores. But the problem is that all this debt puts the future at risk. The credit score won’t help with food or other necessities when debt levels cripple financial institutions and the entire economy.

One-Third of Americans Are a Few Hundred Dollars Away from Destitution

Nearly one-third of the U.S. population said they were experiencing financial difficulties despite a “modest” general improvement in the situation of households, said the Central Bank in a recent report. (Source: “Report on the Economic Well-Being of U.S. Households in 2016,” Board of Governors of the Federal Reserve System, last accessed May 29, 2017.)

It’s difficult to decide which is worse: is it Americans’ growing indebtedness, or is it the fact that real economic growth remains a figment of the imagination?

Many critics like to point out, rather arrogantly, that it’s the average consumer’s fault for getting into debt. You may have heard the expression “addiction to debt.” But that’s not a fair assessment. This so-called addiction to debt has substituted what average American workers used to call “getting a raise.”

Unless you have been a CEO or close to that lofty circle of elite employees in America, chances are you haven’t been getting many raises. You may even have had to accept a salary cut in order to keep your job. But, despite that fact, economists have told us there’s no inflation. That helps justify the stagnating wages, but it fails to account for the fact that the prices of many basic items, including food, housing, education, and healthcare have increased; sharply, at that.

That’s where debt comes in. Americans may borrow from their credit lines or use their credit cards ever more to access some modern luxuries. However, many so-called luxuries are essentials these days; try living without a smartphone or an Internet connection (many need these things in order to work). Nobody is suggesting that Americans should complain because they can’t all drive “Cadillacs.”

No, rather, Americans should complain because they can barely afford to make it until the end of the month with their average salaries. Some 76 million Americans are struggling to get by, or are barely surviving. (Source: “76 million Americans are struggling financially or just getting by,” CNN, June 10, 2016.)

Meanwhile, in Millionaire City….

Meanwhile, a tiny circle of global billionaires control almost 50% of the world’s wealth. Yet, almost half of Americans (44%, or about 150 million people) said they were unable to cope with an exceptional expenditure of a few hundred dollars. They would have to sell something or borrow—i.e. take on more debt—to deal with an expense of $400.00.

As ever, medical bills are a concern for Americans, who are among the few populations in the West that cannot count on a basic taxpayer-funded healthcare system. Thus, healthcare remains at the heart of an intense political battle in Washington, while it continues to represent one of the major burdens and worries for American households. It’s also a huge economic disadvantage for Americans, compared to others.

Europeans and Canadians don’t have to worry about taking on debt for most medical procedures. The picture changes a bit when considering the cost of drugs, but even there, American households still pay more than their counterparts do. Moreover, American companies often use medical benefits as incentives to get the best employees. Thus, medical insurance becomes a burden to businesses, compromising the competition for the best employees.

Then there’s the student debt disaster. Over 30% of those who borrow to finance their education are late in their repayments. Students owe some $1.4 trillion in debt for their education in the United States. That’s three times more than it was just 10 years ago, and it’s becoming a predictor of economic collapse. This is part of the growing debt accumulation, which the Fed has included in its favorable assessment. Student debt is just one of the components of overall debt that is holding back an entire generation of Americans.