Fall Stock Market Crash Odds Elevated as Negative Catalysts Conspire

A much-anticipated stock market crash has proven elusive—so far. But background conditions continue to ripen, which could easily culminate in a “market event” sometime this fall. The fully invested, take note.

And what could constitute a full-blown market event? Declining stock markets north of 10%; a temporary strengthening of the USD; a huge spike to the VIX Index (volatility) triggering plunging stock prices; and a sizable spike in precious metals prices. These are but a handful of probable outcomes should a stock market crash occur.

But why now? What makes this moment in history ripe for a stock market decline, unlike previous periods in the business cycle?

While it’s true that the stock market has climbed a monumental wall of worry with few hiccups, the inevitable crash is guaranteed. It’s always occurred, in every era and every generation. Do you think it’s going to be different this time? We all know it never is. Especially in this cycle, where no amazing innovation of product has been developed (unlike the Internet in the mid-1990s).

So with that in mind, and with a non-stop multiyear surge in stock prices, we believe it’s time investors get defensive. It doesn’t mean one shouldn’t invest or build a bomb shelter in one’s backyard. But it does mean risks could be weighted to the downside, and that owning the right assets will be pivotal to come out ahead. Investors risk being trapped by riding the gravy train right to the very end.

With that in mind, here are three reasons why we believe a stock market crash could happen sooner rather than later (perhaps even this fall).

Tax Reform Is a Bust

At least for the middle class, it appears that way.

The right-leaning Tax Policy Center (TPC) has analyzed the numbers, and they don’t appear bullish for future consumer spending. TPC calculates that taxpayers in the bottom 95% of earners (the majority of Americans) would see average after-tax incomes increase between 0.5% and 1.2% in 2018. This includes 12% of earners in the consumer-active $150,000-$300,000 bracket, who would pay about $1,800 more in next year. (Source: “Trump’s tax plan just got its first brutal review showing how it would benefit rich Americans but almost no one else,” Business Insider, September 29, 2017.)

As consumer spending accounts for 70% of gross domestic product (GDP), it’s hard to envision this being helpful to consumer spending next year. The middle and lower classes also spend a disproportional amount of income in the economy, so trivial cuts to the rich won’t help much.

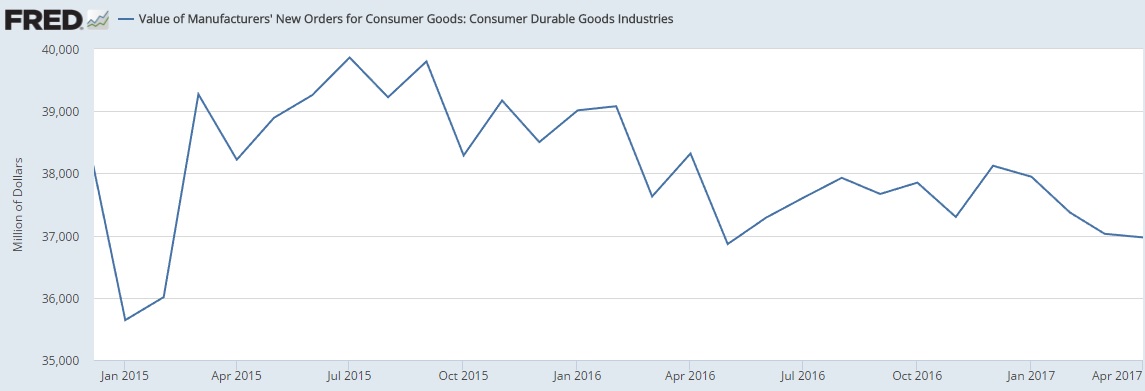

(Source: “Value of Manufacturers’ New Orders for Consumer Goods: Consumer Durable Goods Industries,” Federal Reserve Bank of St. Louis, last accessed October 4, 2017.)

If slowing consumer spending slows in any meaningful way, this mature business cycle may end. Recession will bring sky-high valuations to a halt.

As a forward-looking discounting mechanism, stocks may begin to price this possibility in.

Quantitative Tightening (QT)

We call this “quantitative easing (QE) in reverse.” That is, the Fed is halting bond purchases and allowing bonds on its balance sheet to mature. Without this program in place, the rocket fuel allowing the market to soar is coming to an end.

It’s undeniable that stock valuations have expanded almost exclusively from the sloshing liquidity. Some peg this total to as much as 80%, as the risk-free gains primary dealers obtain through bond sales get re-invested back into the stock market.

Now imagine what happens when the liquidity begins to dry up. That might amount to $50.0-billion/month, starting in spring 2018. That’s a lot of support being wiped away. It’s unclear to us how this doesn’t affect the market in some serious way.

Again, as a forward-looking discounting mechanism, stocks could start pricing this event in. A stock market crash from a liquidity squeeze is a direct possibility.

Declining Consumer Sentiment

The data isn’t showing it thus far, but I believe consumer sentiment could imminently turn south. I try not to let politics infiltrate my forecasts, but recent events make this impossible.

The latest salvo was the deadly mass shooting taking place outside of the Mandalay Bay Casino on the Las Vegas strip. At the last count, 59 people were killed and over 520 injured—some critically.

What does this have to do with the stock market? Quite a lot, actually. The growing sense of insecurity and polarization in the American discourse is not pro-consumerism. If Americans (especially conservative) attend fewer concerts (Manchester (U.K.), Las Vegas), fewer sporting events (take-a-knee protests), conduct more corporate boycotts (Kellogs, Target)… this could affect spending.

For an economy averaging two-percent GDP growth since 2010, it won’t take much to tip the scales into recession.

Overall, polarizing politics could very well equal peak consumer sentiment.