Indicators Are Firing Warning Shots of a Global Economic Slowdown Ahead

The global economy could be headed toward a slowdown.

Why? Because the indicators that tell us the health of the global economy are warning investors that they should watch out for a slowdown ahead.

There are three main indicators that are worth watching closely.

Copper Prices Tell Us That the Global Economy Is Taking a Wrong Turn

The first indicator worth watching is copper prices.

The red metal is nicknamed “Dr. Copper” due to its ability to predict where the global economy could be headed, since the metal has massive industrial uses. If the price of copper tumbles, it means that the economy could be facing headwinds.

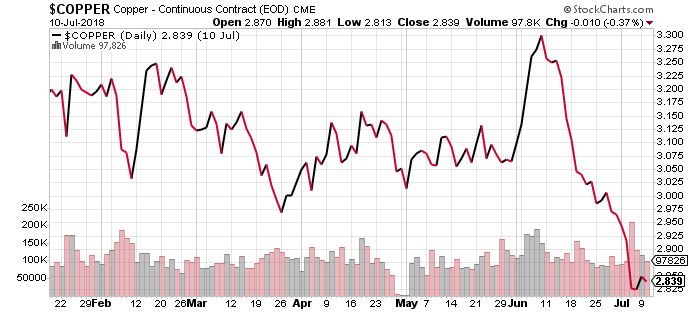

With that said, look at the chart below of copper prices.

Chart courtesy of StockCharts.com

Over the past month, copper prices have tumbled. It seems as if there has been a shift in the copper market. In just a matter of 20-or-so trading days, the price of copper dropped to its lowest level in about a year.

The metal traded at around $3.30 per pound in early June. Now it trades at around $2.80. This is a decline of almost 15.2%.

Mind you, we have not seen a decline in copper prices like this in a while.

At the very least, the price of copper tumbling shows us that the global economy could be turning in the wrong direction.

Global Manufacturing in a Slump, Drops to 11-Month Low

Global manufacturing activity around the world says that an economic slowdown could be likely.

Consider the J.P.Morgan Global Manufacturing Purchasing Managers Index (PMI). It tells us how industrial activity looks in the global economy.

In June, this index dropped to an 11-month low!

The most recent PMI report says, “The upturn in the global manufacturing sector lost further momentum in June, as output and new order growth slowed and the rate of increase in new export business slipped closer to stagnation.” (Source: “J.P.Morgan Global Manufacturing PMI,” IHS Markit Ltd, July 2, 2018.)

This index could drop much lower and foretell an even more gruesome outlook for the global economy. That’s because the report also stated that, in June, global business optimism was at its lowest level in 19 months.

Global Trade Remains Weak

If the trade between economies stalls, it means that a global economic slowdown could be likely.

Consider this: in 2017, the flow of merchandise exports among economies around the world amounted to $17.7 trillion. (Source: “Total merchandise trade,” World Trade Organization, accessed July 11, 2018.)

This figure remains 6.5% below what it was back in 2014.

Sadly, going forward, global trade could really take a hit, due to the trade war talk we have been hearing lately.

Global Economic Outlook and Why Investors Need to Be Careful

The global economy does not look good. We could be headed for a slowdown or even an outright recession sooner rather than later.

With this, don’t for a second think that the U.S. economy and stock market will come out just fine.

The United States isn’t an isolated nation. Think of it this way: if the global economy sneezes, the U.S. economy gets the flu. The U.S. is highly dependent on what happens globally.

As for the stock markets, know this: a lot of American companies have a global presence. In fact, in 2016, 43.2% of sales generated by the S&P 500 companies came from outside of the United States. (Source: “S&P 500 Foreign Sales Decline to 43.2%, at Lowest Level Since 2003,” PR Newswire, July 20, 2017.)

So, if the global economy struggles, the S&P 500 companies could see their sales decline. And what do you think will happen to their stock prices as this happens? Don’t be shocked to see stock prices go lower.