Here’s Why a Stock Market Crash Could Be Ahead in 2017

With the Dow Jones Industrial Average above 21,000 level, a stock market crash isn’t something on investors’ minds. Remember, complacency could end badly; don’t ignore facts. A massive sell-off on the stock market still remains a possibility for 2017.

Understand one thing: stock market crashes are followed by periods of robust returns and extreme euphoria.

What does this mean?

Look at prior to what happened to the stock market crash of 1987.

Also Read:

Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Warren Buffett Indicator Predicts Stock Market Crash in 2017

Between January and September of 1987, the Dow Jones Industrial Average increased roughly 36%. In January of that year, the stock marked showed returns over 13%, still one of the best months on record.

This was all happening on the back of not-so-strong fundamentals. However, investors had a rosy outlook on the market.

On October 19, 1987, the Dow Jones Industrial Average collapsed over 20% in a day. This day was dubbed as “Black Monday.”

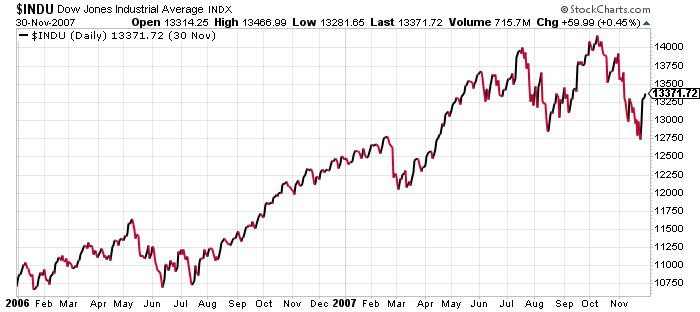

Fast-forward to the stock market crash of 2008–2009. Look at what happened to the Dow Jones Industrial Average just prior to the crash.

Chart courtesy of StockCharts.com

Between July of 2006 and October of 2007 (when the top was formed), the Dow Jones increased over 30%. Again, there was one thing in common: investors had too optimistic an outlook on returns, and fundamentals were deteriorating very quickly.

A major stock market crash followed a few months later. The Dow fell 50%.

Now, if you look at the stock market, the same sort of euphoria is building up and we are seeing huge gains. We also have an overly optimistic outlook among investors and stock pickers and dismal fundamentals. Could a stock market crash follow?

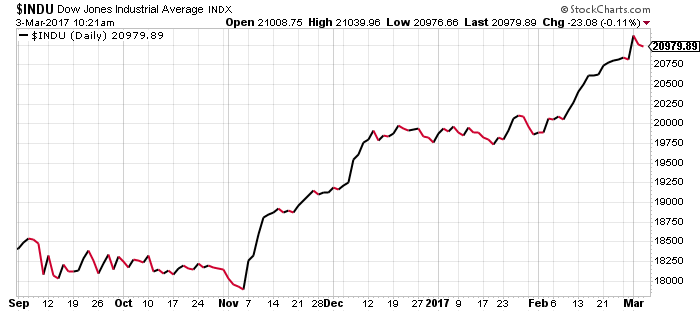

Look at the chart below of the Dow Jones Industrial Average. Pay close attention to what has happened since November of 2016.

Chart courtesy of StockCharts.com

The Dow has increased over 17% in a matter of months. If you listen to the mainstream media, there’s nothing but optimism. Everyone seems to be talking about how fast the Dow will increase.

From a fundamental perspective, stock valuations are relatively high, economic data isn’t as strong, and uncertainty in the global economy remains prevalent.

Credits: Flickr.com/geralt

Stock Market Outlook 2017: Stock Market Crash Inevitable?

Dear reader, there’s one thing to keep in mind always; don’t predict tops and bottoms. It’s very dangerous to the portfolio.

What we see on the stock market, as it stands, are clear signs of euphoria among investors, and returns are nothing but stellar. This is definitely a warning sign, but know that this could go on for a while. John Maynard Keynes explained its best: “The market can remain irrational longer than you can remain solvent.”

But, here’s the thing; irrationality can go on for a while, but if history is any indicator, it doesn’t remain forever.

We also know that when investors are hit with reality after a period of irrationality, they tend to panic and run for the exits. In the midst, we see a stock market crash that takes a huge toll on investors’ portfolios and wealth.

I truly understand, the talk of a stock market crash sounds irrational when key stock indices are soaring. Remember, as said earlier; complacency could end badly.

My final thoughts: be agile, not biased. Preserve capital.