The Course of U.S. Dollar Betrays High Volatility and Contradictions About Inflation

Does anybody know where the U.S. dollar is going? That’s one of the most difficult questions about the economy to answer in 2018. The U.S. dollar index is at a level last seen in October 2015. The EUR/USD exchange rate is at about $1.25. The predictions not too long ago were for the euro and the dollar to achieve parity.

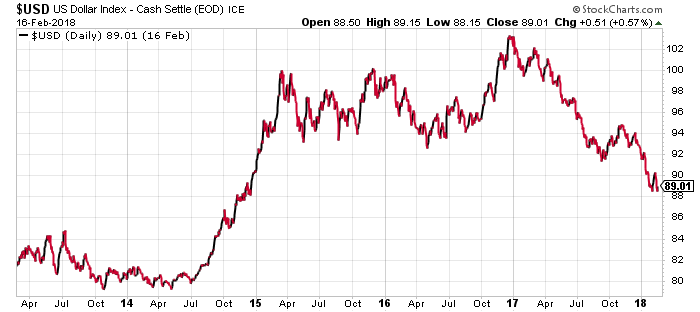

Certainly, that was the trend just before the U.S. election. It was also the trend in October of 2017, when expectations of rising inflation pushed the greenback to the highest point of the past five years, as the dollar index chart below shows. However, as that same chart shows, only a dramatic rise in interest rates can support the dollar’s value.

Indeed, the only reason why the dollar started to rebound in late 2015 was that then-Federal Reserve Chair Janet Yellen applied the first (and well-publicized) interest rate hike after years of the near-zero interest quantitative easing policy.

The dollar’s international clout has governments and individual investors confused. Secretary of the Treasury Steven Mnuchin and President Donald Trump delivered completely opposite statements of where they expected—better still, wanted—the dollar to be in the foreseeable future at the recent World Economic Forum in Davos, Switzerland.

High Dollar vs. Low Dollar: The Truth Is the White House Has No Strategy

Mnuchin spoke of the desirability of a low dollar to boost the amount of U.S. exports, even if he believed in the dollar’s long-term strength. Trump contradicted him barely 24 hours later, saying he wanted a strong dollar. (Source: “Trump Team at Davos Backs Weaker Dollar, Sharpens Trade War Talk,” Bloomberg, January 24, 2018.)

The hike was a mere quarter of a percentage point, but it sent a clear signal to the markets. In turn, Wall Street welcomed the move, because it suggested confidence in a growing economy capable of withstanding the shift. It was a rare case of raising rates to boost the market.

Now, as the dollar continues to slide, the Fed may have to act.

Chart courtesy of StockCharts.com

Consider that the dollar’s value, compared to the euro, has declined even though the European Central Bank (ECB) has not increased its nominal interest rate yet.

This suggests that the relative value of the dollar is much lower than it seems. It also suggests that the Fed to could tighten its monetary policy rather aggressively in 2018. Unlike Yellen’s initial 2015 hike, the markets will not welcome the next phase of monetary tightening. In many ways, raising interest rates may be the only way to cool down and restore balance to the financial markets. They have gained an alarming (if impressive) 33% since Trump won the election.

Why is the bullish sentiment that investors have displayed since Trump was elected “scary?” Simply because the main premise of investors’ confidence in the markets is flawed. The course of the dollar is one of the barometers of the danger that lies within. Inflation is the official reason why interest rates need to increase.

The tax cut (more on that later) is supposed to herald a new era of growth, harking back to the 1950s and 1960s. It’s the essence of the “Make America Great Again” campaign message.

Also Read:

Will the U.S. Dollar Collapse in 2018?

U.S. Dollar Index Forecast (DXY) 2018

Inflation: Do We Want it or Not?

But if inflation fails to rise as many expect, what then? First, inflation remaining at the current level of about two percent is a surprise for Wall Street. Apparently, it’s higher than anyone expected. Yet mere months ago, as late as October, most economists were worried about the opposite problem: there was too little inflation. (Source: “Rising inflation rekindles a big market fear from the 1970s,” CNBC, February 14, 2018.)

It seems that the Federal Reserve is itching to boost interest rates one way or another, but something stands in the way. Nevertheless, the dollar seems slated for a bigger downward correction. If inflation isn’t rising, then the dollar is slowing. If inflation is rising, then the Federal Reserve cannot raise rates enough because doing so would cause the stock market to crash. That risks sparking another recession, forcing the Fed to abandon any plans of shelving quantitative easing.

The result of this is confusion, and therefore volatility, which will remain high. The fact that the arguments both for and against a stronger U.S. dollar alternate without any logic is but one of the signs of volatility.

Another issue that few dare talk about, it seems, is that even if the Fed increases interest rates, there’s the U.S. national debt to contend with (and this is before we start adding the sum total of Americans’ personal debt). The tax reform and proposed spending increases will further increase what is already an over-$20.0-trillion burden.

The only factor saving the dollar is that its role in the financial markets remains dominant. But nothing is forever, not even diamonds, as a famous advertising campaign says. The Chinese and others are on the dollar’s tail, threatening to end its supremacy as the global currency of choice to buy oil and other commodities with the petro-yuan.

The risk, of course, is that the Fed will raise rates, acting preemptively to stop inflation, which is supposedly rising. However, higher rates will make everybody’s debt (including that of the U.S. government) unbearable. It could slow sales of cars—which are still an important driver of economic growth—and homes. It could also increase the amount of interest that many homeowners have to pay on their mortgages.

Higher interest will also force many investors who took advantage of margin to pull out of high-risk investments like equities to find safer alternatives like gold.